My worst trading performance has been when I have gone short. I have made big money (like when I was leveraged short during the fall of 2008 as documented here and here), but I have also lost large amounts of money fighting the hoards of determined bulltards still stuck in last century's paradigms. The tsunami of paper depreciation unleashed upon us over the past decade makes shorting any market much more hazardous than being long. Trust me, I have learned my lesson in this regard the hard way.

Right now, my subscribers and I are short senior Gold stocks as a scalp trade (after catching the high in the GDX ETF on February 2nd). So far, so good. It is almost time to flip back to going bullish on the precious metals sector. When I look at the general common equity markets, I see rabid paperbug froth everywhere. Just a few minor points of extremely bullish sentiment to point out.

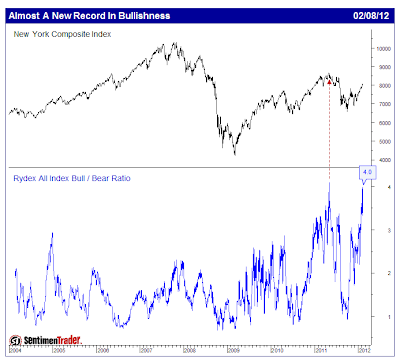

First up, here's a chart from a piece by sentimentrader.com, which examines the ratio of money flowing into a Rydex bull mutual fund versus a bear fund (i.e. examines retail money flows into bullish bets versus bearish bets):

Next up, a chart of a proprietary NASDAQ sentiment indicator from Market Harmonics:

Record highs, eh? I can see why, what with the super-strong economy and what not. And here's the opinion of the trusted and revered investment advisors that always buy low and sell high for their clients (sarcasm off). Following is the NAAIM (National Association of Active Investment Managers) sentiment survey thru last week:

I am thinking a sharp chop lower in common equities followed by a drunken and staggering final charge into a March peak. After that, we'll have to see. But for now, risk is exceedingly high in common equities. There's rarely a need to tell a Gold bull about such risk, as those who have crossed over to the dark side and embraced the secular bull market that is the enemy of the state rarely need reminding that we are in the cycle where paper declines relative to real/hard assets.

Own physical Gold and sleep well. When the Dow to Gold ratio hits 2 (and we may well go below 1 this cycle), consider waking up from that comfortable financial sleep and looking for something to buy with your bling bling. And if you're interesting in speculating in the paper markets after you have established a core position of physical metal held outside the banking system, consider trying my low cost subscription service.

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)