I am a Gold bull. I believe we are in a Kondratieff Winter or secular credit contraction. This is a very different view than many Gold bulls have, which revolves around the theme of "U.S. Dollar goes to zero, Gold and silver go to infinity." De-leveraging is very different than heavy, persistent inflation as a secular theme. But anyone long Gold will be right regardless of their reasoning. I will be buying more Gold if it gets to the $1150 level.

My main focus right now is on shorting general equities, however. I think the next leg of the stock bear market is imminent. I think it will occur in the setting of a rising U.S. Dollar and falling commodity prices. Since many investors and speculators see Gold as just another inflation hedge like copper or oil, I believe they will dump their Gold positions, creating another short-term buying opportunity for me in physical Gold. I may be wrong, but I am in no hurry to buy more Gold now that I have a large, "strong hand," core position.

Secular lows in the yields for U.S. sovereign debt (i.e. world's senior economy) at the same time Gold is at secular highs does not fit into a neat "deflationist" or "inflationist" box for those who think in paper fiat terms, but it fits a Kondratieff Winter like a glove. I believe asset price deflation has been ongoing and rather obvious since 2000, but only when the currency used to "demonstrate" deflation is Gold. The debt-based global fiat system distorts the picture significantly.

Now, in any monetary system ruled by bankstaz and their lap dog governments, the way out of the predicament is simple: destroy the value of the currency. However, the time line for such a "managed" versus chaotic free market adjustment to the value of the currency is unpredictable. How can one say the complete destruction of the U.S. Dollar will occur before the year is over with a straight face? Japan proves that obviously unsustainable government debt can take quite a long time to manifest as a serious currency event. No, the U.S. is not Japan, but we're not Zimbabwe either.

Taking "a stand" on the inflation versus deflation debate is as useful as taking a stand on the Democrat vs. Republican issue. Obviously, inflation will always win over the longer term cycles when a currency is not fixed rigidly to Gold. But this does not help the trader or speculator. It is important to recognize what is in a secular bull market (Gold, U.S. debt) and what is in a secular bear market (general equities and real estate).

When the current cycle is over, Gold will have outperformed cash. Why? Because no matter what happens, the nuclear option will always be on the table and the worse things get, the more palatable it becomes. The nuclear option always works from the viewpoint of a government or banksta. What is the nuclear option? Currency destruction. Those who say you can't devalue in a global, anchorless fiat world are naive and lack imagination. A global "trade" currency, whether or not backed by anything tangible, would allow everyone to devalue in spurts and fits relative to this "trade" currency. Nefarious organizations like the IMF stand ready to take on the task.

Gold has been and will continue to act as a currency in this ongoing saga. It remains the currency of last resort and we are getting close to a time when that last resort will be used to do what Gold has always done: reset the monetary system (for better or worse). Gold is the strongest currency in the world because it is immune from (and benefits from) the nuclear option. Gold is my largest position because it is the only no brainer long term investment for the current cycle. The purchasing power of Gold will continue to rise as the secular credit contraction grinds onward and destroys the bloated prices of things sustained by debt in the prior cycle (e.g., common stocks and real estate).

These big picture themes keep me focused and are obvious on long-term price charts. However, such themes are no fun for the trader/punter that seeks to profit from shorter term swings. These swings have nothing to do with the fundamental long-term themes described above. Not recognizing the difference between short to intermediate-term technical swings/moves and long-term secular trends can cause one to lose a fortune when playing in the casino (trust me, I know).

I am not recommending a speculative approach at all, but I use such an approach with a portion of my capital. Most with excess savings would be best served by buying physical Gold, holding it outside the financial system and waiting for the storm to pass. Once the Dow to Gold ratio gets to 2 or less (we could go below 1 this cycle), selling most of one's Gold position and buying equities "for the long term" will make sense unless one is thinking in multi-generational time frames (i.e. keeping some family wealth in the form of physical Gold to be passed on to future generations without telling the tax authorities).

All the short-to-intermediate term charts I follow for trading purposes are now stretched and looking for a catalyst for another trend change. I am hoping to load up on shorts this week, but will only take the trade if the opportunity presents itself. Here are a few short-term charts with my thoughts. First, the copper to Gold ratio (using JJC:GLD as a proxy to allow intraday charting) over the past 4 months using a 60 minute intraday plot:

And here's a 6 month chart of global equities using the Dow Jones World Stock Index ($DJW) as a proxy (60 minute intraday plot thru Friday's close):

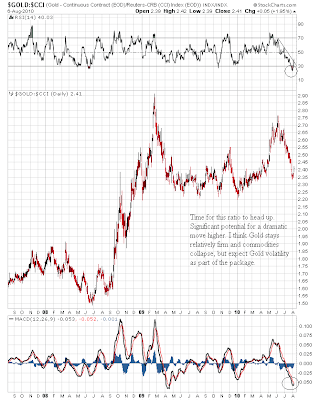

Following is a 3 year daily chart of the Gold ($GOLD) to commodities (using $CCI as a proxy) ratio thru Friday's close:

The anticipated upward move in the Gold to commodities ratio chart above is bullish for Gold stocks, but only in a fundamental sense, not a trading sense (i.e. a rising Gold to commodities ratio often occurs as Gold stocks are falling, at least initially). Gold stocks continue to lack leverage to the Gold price and I believe they will be transiently caught up in what I think will be a big move down in the world's stock markets. I continue to wait patiently for what I think will be a dramatic buying opportunity in Gold stocks within the next few months. I will be buying Gold stock indices hand over fist if senior indices decline about 20% from current levels (e.g., looking for GDX level around 40). This week, though, my focus will be on building a big equity short position primarily using puts on the triple bullish UPRO ETF that tracks the S&P 500.

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)