src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

All I can say about palladium is - wow! Here's an 18 month daily linear scale chart of the U.S. Dollar-based palladium price thru yesterday's close:

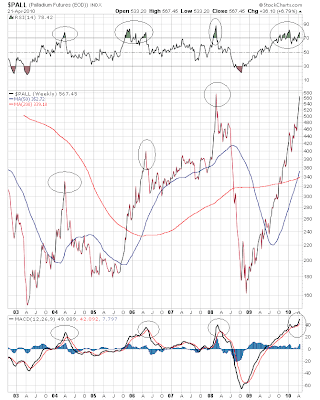

As the chart shows, the price pattern has now gone parabolic. Following is a 7 year and 6 month log scale weekly chart to show the recent previous parabolic-type runs in palladium. I used this time scale to eliminate the high palladium price and its subsequent collapse related to the internet bubble.

Just to show how "out of whack" palladium is relative to other commodities, here's a weekly linear scale chart plotting palladium relative to other commodities, using the CCI commodities index (i.e., a $PALL:$CCI ratio chart) over the same 7 year 6 month time frame:

Trying to pick the precise top of a parabolic move is impossible (though bragging rights are granted to those who guess correctly). However, what comes after a parabolic move is relatively predictable: a big drop. I know it's profound, but after the price goes way up, it comes back down for a while. The current move in palladium is not sustainable. That doesn't mean its bull market is over, but it does mean a 6 month or longer consolidation is likely to begin soon based on recent past parabolic spikes. The current cyclical bull run in palladium doesn't seem likely to last more than another month at most.

Gold and silver need to join the party soon, as a palladium bust is unlikely to be kind to the other precious metals over the short to intermediate term. To show you what I mean, here is a 7 year 6 month chart of the palladium price (black linear plot) versus the Gold price (red and black candlestick plot):

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)