src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

And that target is it's all-time highs. Remember that Gold miner fundamentals are improving as the general economy fundamentals are collapsing. This is one of the reasons why Gold and Gold miners have been great countercyclical assets over the past century of American investing.

Yes, Gold and Gold stocks are simply running with the bulls right now, as everything is up but the U.S. Dollar, but there's a critical difference between the Gold patch and other asset classes: Gold and Gold stocks are in a secular bull market caused by the early stages of a new secular credit contraction, also known as a Kondratieff Winter. Other asset classes are largely in secular bear markets, with the most important ones being general stocks and real estate, which are terrible long-term investments right now. Commodities and the U.S. Dollar are wild cards still being argued over by financial experts as some are calling for deflation and others for inflation.

Me, I'm in the deflation camp for now but in the end I don't care, as I am sticking with Gold. Gold does well during a credit contraction, regardless of whether the U.S. Dollar holds up or not, and protects against a currency crisis that we all know is coming sooner or later. Gold stocks LOVE credit contractions because this causes the "real" (i.e. actual as opposed to the nominal) price of Gold to rise. This is because Gold is money and cash is king in a secular bear market and thus the purchasing power of Gold is rising and will continue to do so as this credit contraction grinds on. This deflationary trend increases Gold miner profits (for those not interested in quibbling about academic theory and definitions, this "deflation" is best thought of as asset price deflation relative to the Gold price in an anchorless paper fiat world).

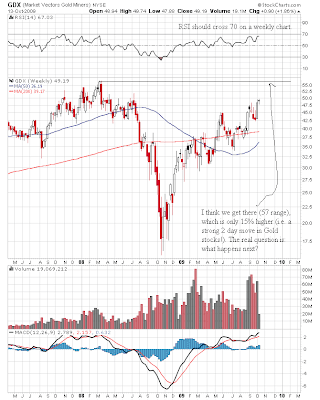

Anyhoo, Gold stocks have been on a tear lately and senior Gold stocks are nearing their first major target level: last year's highs. Here's a 30 month weekly chart of the senior Gold miner ETF (ticker: GDX):

I don't know what happens after we get to last year's high in senior Gold stock indices, but I think we'll get there at a minimum. I do know that this would be a good place to either take some profits off the table or at least place some stop losses if one is a trader. Those in it for the long haul need to be aware of two things: first, this Gold stock bull market has a LONG way to go when one thinks in terms of years rather than days. Second, the corrections in Gold miners will continue to be steep and will test your resolve.

As a teaser of what's to come in all but the worst managed Gold stock companies, take a look at the IAMGOLD Corporation's (ticker: IAG) 30 month weekly chart:

Gold is overbought, but it can stay that way for a long time during a strong uptrending move. My Gold is not for trading so I'm just enjoying the move while it lasts. Until the Dow to Gold ratio reaches the 1-2 range, Gold is a long-term hold for me.