src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

I think the British Pound broke down today. This is something U.S. Dollar bears need to keep in mind when talking about the U.S. Dollar collapsing. Because the U.S. Dollar is the reserve currency of the world, it will actually take longer to collapse than other currencies. The British Pound is a good "canary in the coal mine" situation for those worried about the long-term health of the U.S. Dollar (like me!).

This is why looking at the U.S. Dollar Index ($USD) is misleading. This index simply measures the value of anchorless U.S. paper money relative to other countries' anchorless paper money. If all fiat currencies are sinking or rising together (the latter only a theoretical construct not to be taken seriously), apparatchiks who trumpet the glory of paper promises can point to their paper index and tell you how "strong" their currency is and yet their citizens can still be losing purchasing power!

Anyhoo, here's a 30 month weekly chart of the British Pound ($XBP) using a log scale candlestick plot:

And here's the Pound's more recent price action using a 10 month daily linear scale candlestick chart to show today's breakdown:

Now, I'm not trying to pick on the British Pound, as when the U.S. Dollar is going up over the next few months, you can bet that the Euro, Canadian Dollar, Australian Dollar and Swiss Franc will all be declining. The British Pound simply had the most classic break-down chart pattern I could find in this bunch. The Japanese Yen is such a basket case and has been for so long that it will likely rise as well during the next deflationary wave (not sure).

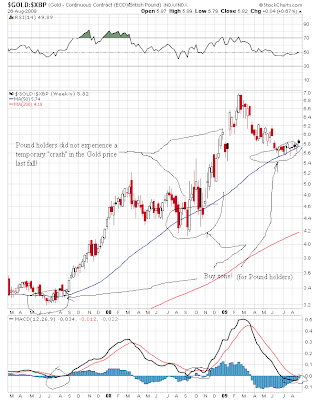

On the flip side, this is where it gets tricky as a Gold investor when measuring your gains. If you were an American Gold holder last fall, you were probably disappointed at how Gold did. However, the Gold price chart looks different when denominated in British Pounds (I am using the U.S. Gold Price divided by the British Pound Index [i.e. $Gold:$XBP] as a proxy). Following is a 30 month weekly log scale candlestick chart of the Gold price in Pound terms:

The Gold price is not rising only because the U.S. Dollar is falling, although that's part of it. The Gold price is rising relative to all currencies (yes, including the Japanese Yen) because it is in a secular bull market relative to the global fiat currency system. It is Gold's time to shine relative to other asset classes and the ongoing secular bull market in Gold and Gold stocks has a long ways to go. I am not a commodity bull, I am a Gold bull.