src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

See previous posts for background info, but I think we are setting up beautifully for a tradeable senior Gold mining stock bottom. I believe patience will be rewarded for those looking to invest in this sector and it won't take long. Daily spikes in the Gold mining sector and Gold price used to get me concerned about missing "the big move" that all Gold stock speculators dream about. I no longer have that concern as I have learned to buy Gold and Gold stocks on weakness, not strength.

The current chart pattern in the senior Gold mining sector, using the GDX ETF as a proxy, creates a strong sense of deja vu for me as I have been here before. The correction in the GDX price is incomplete-looking to me and I await the final panic spike down to complete the correction and provide a fantastic buying opportunity. Below is a current 3 month daily candlestick chart of the GDX up thru Friday's close:

And below are two recent GDX examples of why such a pattern is cause for patience, using the "real-time" set ups of similar patterns from August of 2007 followed by April of 2008 during recent senior Gold stock corrections:

And following is how both of these two corrections subsequently resolved:

Could it be different this time? Of course. Could I be completely wrong? Of course - my track record over the last few months on short-term trading calls has been shitty to say the least. However, in a major bear market in the general stock market, one should not be in too much of a hurry to go long anything and Gold stocks are no exception. The volatile creatures that they are, Gold stocks almost always spike down in a panicky rush at the end of a correction and the time for that to happen should be in the next 2 trading weeks. For those looking to get long in this sector, be patient and be ready.

This feels like August of 2007 to me. One last brief panic spike down in the senior Gold miners and price of Gold to shake out the weak hands would be a perfect set-up for a launch higher into the fall. My only concern with the Gold miners is that it's tough to make much progress higher during a bear market leg down. However, whether a good intermediate-term trade and/or the best long-term buying point of the second half of 2009, I think a significant bottom in the senior Gold mining sector will occur in August.

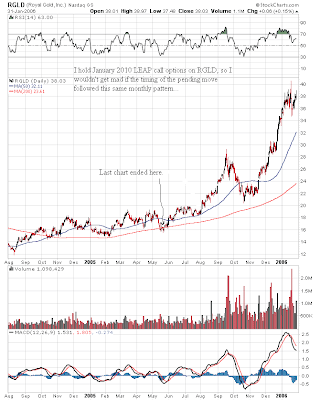

On a related note, those who took the dive into Royal Gold (ticker: RGLD) like I did are probably getting bored waiting. The correction in RGLD continues and has lasted far longer than I thought it would. I remain long and wildly bullish on this stock. I found an encouraging 2005 fractal chart pattern that may apply to the current correction. First, a current 11 month daily candlestick chart of RGLD: