Don't try to catch this falling knife right now. Some 2 year charts follow - the new lows parade is in full force.

The Dow Transports ($TRAN):

The country of Spain ($SMSI):

The Swiss ($SMI):

Philadelphia Banking Index ($BKX):

Philadelphia Regional Banking Index ($KRX) - smaller banks are broke, too:

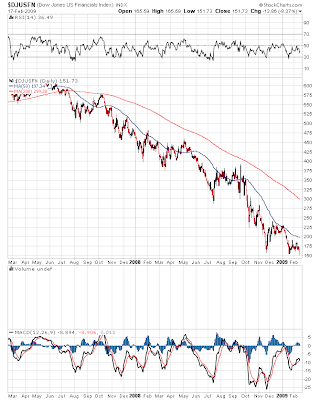

The Dow Jones US Financial Index ($DJUSFN) - destruction of the FIRE economy in progress:

Caterpillar (CAT) - a company that actually makes things of value:

Dow Chemical (DOW) - all I can say is holy shit:

Proctor and Gamble (PG):

It's getting ugly again and now is NOT the time to step in and be a brave bull while this bear rips out entrails and lays companies to waste. I remain short. Remember the 3 things I am looking for to start thinking about going long again, as they haven't changed and none of them has happened yet:

1) RSI down to 30 level/range on a daily chart of the $SPX

2) Put to call ratio ($CPCE) should reach or exceed 1.10 on a daily chart

3) The Volatility index ($VIX) should reach or exceed 55

By the way, these factors are just when I start to think about going long, not that I will automatically go long once these conditions are met!